By Gadjo Cardenas Sevilla

Tax Season becomes particularly tedious for self-employed workers who have the challenge of saving expenses as well as profits and also determining which of these are personal or for work purposes.

Until now, most online tax preparation and submission services didn’t really focus on the needs of the self-employed. Like many self-employed freelancers working in the gig economy, I’ve entrusted my family’s tax filings to professional accountants.

I usually gather all receipts, deductible forms, donations as well as spreadsheets full of income and expenses and submit these to my accountant, crossing my fingers that they will be able to make an accurate and timely filing for me.

Being Tax Season, the accountants are usually extremely busy. It takes time for them to review the material, get back to me with any questions. Any clarification can add up to a week of back and forth.

Hiring an accounting firm to do your taxes and submit them electronically for you is expensive. I’ve been paying upwards of $1,000 each year for this service.

To my dismay, despite submitting everything on time and accurately. It turns out the accounting firm had some errors, which required me to make additional payments. I lost confidence that hiring an accountant was the best way to go.

This year, I’ve discovered tools and technology that can help self-employed workers gather and submit their taxes.

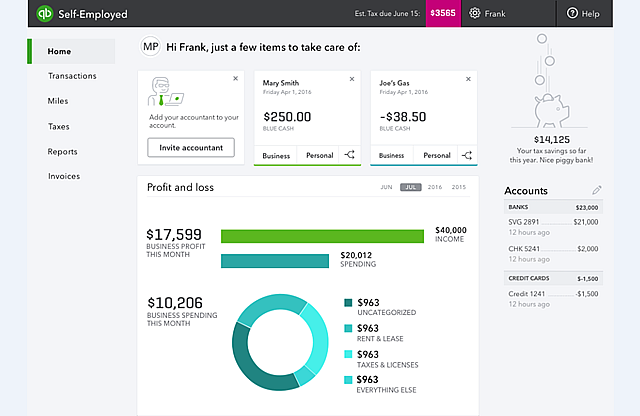

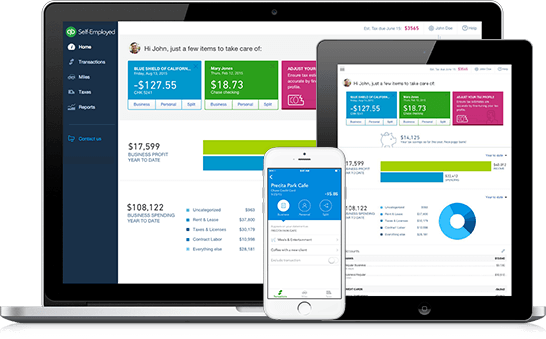

Intuit QuickBooks Self-Employed mobile app

Intuit’s QuickBooks Self-Employed mobile app eliminates the pain points associated with financial management and helps self-employed workers easily manage their operations from anywhere.

“We identified this new market, the independent contractor and we noticed that there wasn’t a quick adoption of the traditional QuickBooks App. We did a ton of research and identified what their unique needs were. Rather than needing a full financial picture of their business, the things that were important to them were being able to keep track of their expenses and getting ready for tax time,” says Malika Hope, Senior Product Manager at Intuit.

“We wanted to come up with a simple app to use that would be a big uplift. You wouldn’t necessary have to work with an accountant. It would be super intuitive to help them get there.” Hope adds.

The app, which I installed on my iPhone, was easy enough to use and has specific sections for tracking expenses, mileage and sending invoices.

“It is designed for a self-employed users filing a T-1 Tax Return. There’s a form on that return called a T2125 where you report you’re self employed income and expenses. We have invoicing and allow you to accept payments through the app. If you’re using the invoicing function there, we will have a record of the income you’ve created with your business,” Hope notes.

“We allow users to categorize their expenses according to the T2125 form. when it comes to tax time and you’re filling up that form you simply have to go to your Tax Tab and you can see the totals you have for each expense category and you simply input that information to a form and you should have most of what you need to complete that.”

“Before we launched this product, customers would go through a really manual process of keeping track of every receipt throughout the year. When it came to tax time they would take all those receipts, try and remember if it was related to business and then enter it into the form. With the app, we encourage users to do that real time so at tax time all the information is already organized.” She explains.

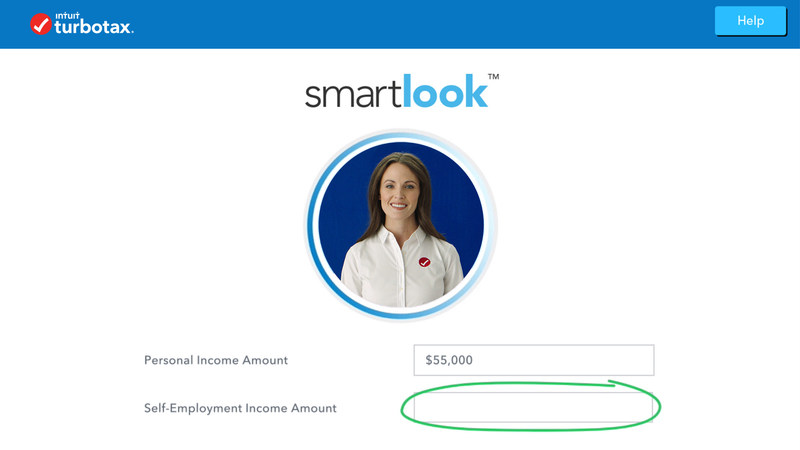

TurboTax SmartLook

Intuit’s TurboTax Helps Ease Canadians’ Fears About Missing out This Tax Season with Revolutionary Live Tax Assist Technology (CNW Group/Intuit TurboTax)

Fear of filing taxes without professional help isn’t unique to self-employed people. A recent TurboTax Canada study found that nearly half of all Canadians are not comfortable filing their own taxes, and of those who aren’t comfortable, 48 per cent feel that way for fear they will miss something a professional wouldn’t.

Their solution? TurboTax Smartlook, a feature specifically designed to facilitate customer confidence through live assistance. Self-employed workers can file taxes online knowing that they can access a lifeline; the keen eye of a tax professional, should they require it.

SmartLook is an online, on-demand service that enables Canadian taxpayers to get live, one-on-one tax support from TurboTax Experts who have an average of 17 years of tax preparation experience, and product support from TurboTax Specialists. Launching the service is simple, with access from ‘Help’ within TurboTax Online. For added convenience, customers can schedule a time when they would like to speak with the TurboTax team.

“Technology is playing a major role in the tax filing process today, and at TurboTax, we’re proud to be ahead of the curve providing busy Canadians with tools that empower them to file with confidence,” says Jeff Cates, President of Intuit Canada. “We understand that consumers often want the chance to get trusted advice during their tax filing process. With SmartLookour customers receive on-demand access to product and tax experts to answer any questions and review their return to ensure it’s complete, accurate, and they get their maximum refund.”

These are the tools I’m planning on putting to use this tax season as I make the leap into taking control of my tax application.

Related: