By Gadjo Cardenas Sevilla

Deposit cheques with your smartphone, video conference with a remote teller, pre-select ATM withdrawals on your mobile device. These are just some of the solutions coming to a bank near you.

NCR Corporation is spearheading the self-service revolution and recently showcased a number of payments, retail and personal banking solutions that are already in use in some parts of the US but are headed to Canadian banks in the very near future.

Leveraging the power of smartphones, secure transactions, near field communications (NFC) as well as cloud computing an secure VoIP (Voice over Internet Protocol) solutions, we were treated to a showcase of solutions that can revolutionize how people bank and purchase.

NCR Corporation has working solutions to make smartphones better tools for banking, payments and retail tools

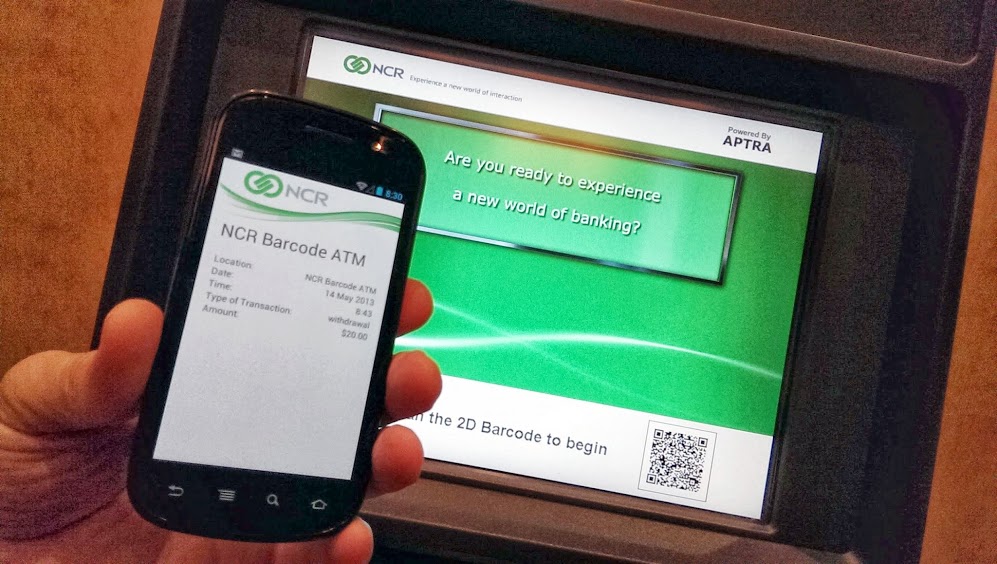

One demo showed how you will be able to pre-set your withdrawal amount on your smartphone via a banking app and then enable touchless banking with an ATM by generating a unique QR code which facilitates the transaction. No need for PIN number or even NFC (Near Field Communications) since any feature phone or smartphone can generate a QR Code.

I was given a demo showing how a smartphone can be used to photograph a cheque and then instantly deposited into one’s bank account. Smartphone cameras can also be used to scan paper cheques and once some qualifying criteria are met, users can deposit the cheque directly to their account via WiFi or their smartphone’s data connection.

A similar solution for home users makes use of a flatbed scanner and a web application to do the same thing. This saves people who rely on cheques a lot of time and is a convenient and secure way to deposit these to their accounts quickly.

Another innovative solution was an ATM that featured video-conferencing capability. ideal for remote locations or for extending banking hours to serve customers longer, the Interactive Teller ATM is connected via a high-speed data line to a call centre where a live teller can be spoken to and seen on camera.

What is unique in this solution is that the teller has remote access to all the functions of the ATM. This means should a customer need service that may not be available through automation, they can interact directly with the remote teller.

This works in instances where a debit card is missing and someone needs access to their cash. The remote teller can ask the customer a series of questions, check their information and if satisfied with the user’s credentials, can dispense money remotely.

NCR Corporation also showed off innovative retail solutions such as apps that allow you to scan items in a grocery as you pick them off the shelf. Aside from giving you a running total of your expenses, the app can use artificial intelligence to surmise that since you’re buying buns, hotdogs, and paper plates that you might also want to get plastic forks and napkins.

Apps like these can also be used to send customers news on deals, coupons and like Amazon’s suggestion feature, let the know what other users with similar tastes have purchased.

NCR Coporation’s Toronto roadshow was fascinating not just because it featured innovative solutions that make sense for end users but also because most of their products are actually good to go and can be adapted to suit most banks, financial institutions and retailers. In many ways, the future is already here.