![]()

By Gadjo Cardenas Sevilla

A lot of tax software filing and tracking solutions are designed for individuals or businesses which leaves out various self-employed professionals as well as freelancers who have to navigate treacherous waters of accounting preparation.

Self-employed workers are faced with a lot of pain points when tax time comes around. Not only do they need to carefully monitor expenses as well as send and follow up on invoices for jobs, getting all the necessary information to file taxes accurately and on time is a constant challenge.

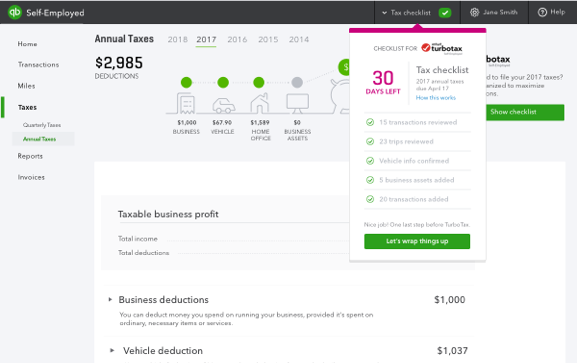

Thankfully Intuit’s QuickBooks Self-Employed mobile app eliminates the pain points associated with financial management and helps self-employed workers easily manage their operations from anywhere. The subscription-based app (which normally costs $10 a month, but is currently discounted for tax season for $5 a month).

“We identified this new market, the independent contractor and we noticed that there wasn’t a quick adoption of the traditional QuickBooks App. We did a ton of research and identified what their unique needs were. Rather than needing a full financial picture of their business, the things that were important to them were being able to keep track of their expenses and getting ready for tax time,” says Melika Hope, Senior Product Manager at Intuit.

![]() “We wanted to come up with a simple app to use that would be a big uplift. You wouldn’t necessary have to work with an accountant. It would be super intuitive to help them get there.” Hope adds.

“We wanted to come up with a simple app to use that would be a big uplift. You wouldn’t necessary have to work with an accountant. It would be super intuitive to help them get there.” Hope adds.

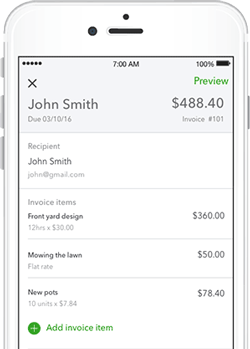

The app, which I installed on my iPhone, was easy enough to use and has specific sections for tracking expenses, mileage and sending invoices.

The best feature for me was that it consistently kept tax time in my mind as I listed down expenses, segregated personal and business expenses, marked my car mileage for work.

Having a means to enter information on a day-to-day basis right on your phone makes tracking finances secure and convenient.

There’s also the ability to import expenses from my bank account. I also appreciated the convenience of being able to create and send invoices right from the app. This works for some clients, however many clients have their own standard.

We allow users to categorize their expenses according to the T2125 form. when it comes to tax time and you’re filling up that form you simply have to go to your Tax Tab and you can see the totals you have for each expense category and you simply input that information to a form and you should have most of what you need to complete that.”

“Before we launched this product, customers would go through a really manual process of keeping track of every receipt throughout the year. When it came to tax time they would take all those receipts, try and remember if it was related to business and then enter it into the form. With the app, we encourage users to do that real time so at tax time all the information is already organized.” She explains.

The app also provides automatic mileage tracking using smartphones. A feature that Intuit says helps when attributing mileage expenses to self-employed use.

“We found a lot of self-employed people drive around with a mileage log on their car or they write down every single trip. We know mileage is an area where the CRA are really strict when they audit. If you don’t have a comprehensive mileage log when you travel, you can find yourself in trouble.”

Users will have to determine if the subscription price of the Self-Employed app is worth it for their needs.

For contractors like myself, who do not have a full-time bookkeeper or accountant, knowing that I have the guidance of a company like Intuit in the palm of my hand saves me a lot of grief in the day-to-day running of my business.

This allows me to focus on clients and projects while keeping apprised of my financial picture in real time.

Related: