Tax season is upon us once again, and it can be a frightening task for both individuals/families and businesses. Luckily, there are plenty of software options, and even apps, that can help ease the filing burden.

Personal Tax Filing

If you’re filing a return for yourself, or your family, there are lots of software products you can purchase in physical form, or download online, to help you check every box, dot every “i” and cross every “t.” For example, many individuals don’t realize they can claim things like textbook purchases or rent for students, a first-time homebuyer’s credit, RRSP contributions, the child’s fitness tax (which ends after this year’s filing), and even medical expenses. And some small business owners or self-employed individuals aren’t aware of potential deductions like research-related costs (e.g. magazine purchases or television subscriptions), and a portion of the mortgage interest should they operate from a home office. Software can help make sure you maximize all of those items.

TurboTax

TurboTax

There are a number of TurboTax options, but for most families and individuals, the simple TurboTax Basic will suffice. With it, you can file up to four returns. If you have a large family, and/or will be handling taxes for your aging parents, or other family members, you can opt for TurboTax Standard, which lets you file up to twice as many returns. In both cases, the software will guide you through each step and page of the return, providing detailed instructions or definitions when needed. It’s designed for use on the Windows and Mac operating systems.

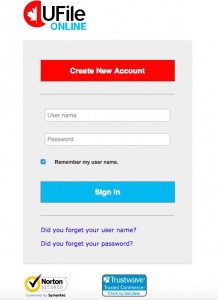

UFile

UFile also offers great options for families and individuals filing an individual return,  including UFile Online, which starts at $17.95, but is free until you’re ready to file, and is always free for students. It works on a Mac, Windows, tablet, and mobile, and lets you easily import the prior year’s tax return from TurboTax and H&R Block, and auto-fill content from the CRA. Free e-mail and telephone support is also offered. For those with relatively simple returns, this might be a good option. It works with both Windows and Mac operating systems, and can even run on iOS and Android tablets if you prefer to get things done on a more portable device.

including UFile Online, which starts at $17.95, but is free until you’re ready to file, and is always free for students. It works on a Mac, Windows, tablet, and mobile, and lets you easily import the prior year’s tax return from TurboTax and H&R Block, and auto-fill content from the CRA. Free e-mail and telephone support is also offered. For those with relatively simple returns, this might be a good option. It works with both Windows and Mac operating systems, and can even run on iOS and Android tablets if you prefer to get things done on a more portable device.

Small Business Filing

Small businesses have a different set of needs, and thus will require more comprehensive tax filing software that allows them to account for things like HST/GST payments, payroll, and other related business costs and write-offs. There are plenty of options for SMBs, including general accounting and bookkeeping software that incorporates tax-related features to make the process easier once you reach tax time.

Intuit Quickbooks Desktop Pro 2017

Intuit Quickbooks Desktop Pro 2017

Use this software to manage your business accounting throughout the year. When tax time arrives, you can find all of the details you need for the forms. The software also includes the capability to file your GST/HST directly to Canada Revenue Agency (CRA).

Intuit Quickbooks Desktop Pro + Payroll 2017

If you have a good number of employees, you’ll need to add payroll management to your list of tax to-dos. This piece of software lets you create payroll tax filing, and includes updated government tax tables that you can follow. Like the version without the Payroll option, this software also allows for direct filing of GST/HST. It’s compatible with Windows PCs.

TurboTax Home & Business

An ideal option for sole proprietors/freelancers or small business owners, this software guides you through the process of filing both personal and unincorporated business taxes. Like the other options, you can download 2016 information directly from the CRA in a few clicks, and automatically import your tax slip information. The software will help you with self employment-related deductions, and other things you can claim. It’s only, however, available for Windows PCs running Windows 7 or later, and with the Internet Explorer browser, version 9.0 or later.

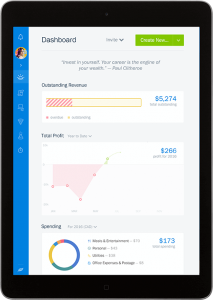

Freshbooks

Freshbooks

While this isn’t tax software, per se, this cloud accounting software can help you keep track of relevant tax calculations throughout the year. As you create an invoice, you’ll be able to see automatic tax calculations. The ability to import expenses directly from a bank account or credit card, take a photo of a receipt to log it, and have everything automatically organized into relevant categories, makes it easy to keep track of this crucial data so you have it at your fingertips come tax time.

Mobile Apps For Filing Taxes

Yes, there are even mobile apps that can help you file your taxes. File Canada Tax by FASTNEASY SERVICES INC.. provides step-by-step guidance for filing your taxes with Revenue Canada via Netfile. You can connect to your CRA My Account service through the app, download your tax information for the current year, and update your tax slip information, all from an iOS device. It works across Canada, with the exception of Quebec, Northwest Territories, Yukon, and Nunavut, and does not support self-employed individuals. But if you’re filing a personal tax return, it might prove useful.

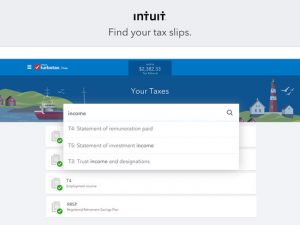

The TurboTax Free (Canada) app also lets you file your tax return from a mobile device, including in the province of Quebec for the 2016 tax year, and is offered in both English and French. An auto-fill feature will automatically populate certain information imported from your CRA My Account, then you can print and mail your return, or submit it electronically, directing to Revenue Canada via Netfile.

The TurboTax Free (Canada) app also lets you file your tax return from a mobile device, including in the province of Quebec for the 2016 tax year, and is offered in both English and French. An auto-fill feature will automatically populate certain information imported from your CRA My Account, then you can print and mail your return, or submit it electronically, directing to Revenue Canada via Netfile.