As one of Canada’s leading banks develops its own technology in-house, it is now offering new financial services to Canadian companies doing their own tech work.

Toronto-Dominion, Canada’s second-largest bank, is now providing new banking and financing services to technology and innovation companies anywhere in their growth cycle, anywhere in the country.

Through a newly-formed business unit called TD Innovations Partners (TDIP), full business services – anything from bank account set-ups to meetings with investors – are being targeted to Canadian tech companies. Shez Samji, a tech banker hired from the Canadian arm of failed U.S. lender Silicon Valley Bank last year, will head the new operation.

The announcement that introduced the new unit came on the heels of TD Tech & Innovation Day, the bank’s annual event at which presentations describe the bank’s range of in-house tech development initiatives.

This year, the event featured news about digital accessibility for all, AI and VR developments for staff, and yummy treats for dogs from a new kind of ATM!

During the tech event, this year held atop the TD Centre in downtown Toronto, Senior Vice President and Chief Architect Licenia Rojas said the company has grown its patent investor base more than 40 per cent in recent years and its patent portfolio covers 2,500 patent filings – an increase of over 110 per cent – since 2020, with one in five patents related to AI innovation.

(Canadian banks like TD, RBC, and Bank of Montreal all rank in the top 10 for AI innovation and all three were among the top 10 patent-filing banks, according to industry surveys.)

For its part, TD is using now generative AI to help customer service agents answer client questions more quickly and help engineers speed up their code development. It has also been using machine learning to pre-approve mortgages and home equity lines of credit (HELOCs) and approve term-life insurance, often within seconds, the bank says.

The generative AI virtual assistant provides summarized responses using conversational language to contact centre colleagues, and it includes links to the TD policies and procedures used to source its answers to customer inquiries.

The tools were developed by Layer 6, an AI startup acquired by TD in 2018 that became TD’s AI research lab. Its over 200 in-house employees have developed almost 50 AI solutions for multiple lines of businesses at TD.

Immersive VR tools are being used to help train and connect staff in 20 TD branches across Canada.

Also unveiled during Tech Day were immersive VR tools now being used to help train and connect colleagues in 20 TD branches across Canada (an additional 11 locations in the U.S. will use the program).

Donning the headset, TD employees assist customers in a virtual branch setting, and different simulations create unique customer interactions that can be addressed a safe space to build employee experience and confidence.

TD also announced during Tech Day that it was joining with March of Dimes Canada to improve online accessibility and digital equity.

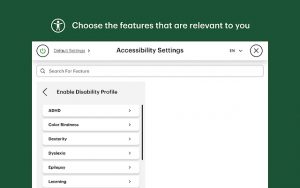

The TD Accessibility Adapter, a browser plug-in with tools to personalize the online experience, will be integrated into all March of Dimes Canada operations, available for service users and employees across Canada.

The software tool lets people set and update their individual accessibility preferences with features such as reading guides, adjustable font size, turning off auto-play videos, a dyslexia-friendly font, and monochrome and dark modes. The plug-in for Chrome can be used without using overlays and to co-exist with other assistive technologies, such as standalone screen magnification software.

TD developed a software tool so people can set and update their individual online accessibility preferences.

Launched initially for internal use, then updated following in-house testing and feedback, the Bank eventually offered the free tool to the public in Canada and the U. S., and now to March of Dimes Canada.

“[A]s technology moves at an increasingly rapid pace, we’re seeing more and more barriers like cost and accessibility appear,” said Lesley Smith, Executive Director and Vice-President, Skills Development & Employment March of Dimes Canada. “The TD Accessibility Adapter helps address some of those barriers, which is why we’re so excited to leverage the tool with our network – including our employees – to help level the playing field.”

March of Dimes Canada, she adds, seeks to create an inclusive, barrier-free society and help the more than eight million people with disabilities across Canada unlock the richness of their lives.

The new collaboration with TD marks one of several accessible technology programs the charity offers, includes its Hi, Tech!, SkillingUp, and Tech for Good programs, all designed to help people with disabilities in Canada build their digital skills and be actively engaged digital citizens.

Also unveiled at TD Tech Day, another partnership and an app for active, digitally engaged dogs.

Together with the Toronto Humane Society, TD unveiled a doggie ATM – an automated treat machine.

Together with the Toronto Humane Society, TD unveiled a doggie ATM – automated treat machine.

The canine-friendly tech gadget delivers two or three edible doggie treats into a metal food dish when a built-in sensor mat detects those four paws. First launched as a pilot at a Philadelphia TD branch, the new dog ATM makes its Canadian public debut in the new TD Terrace building on Front Street West in Toronto this summer.

It was back in 2014 when TD first opened the doors on its high-tech innovation lab at Communitech in Waterloo, where tech ideas, prototypes and products are still developed and tested. As mentioned, in 2018, TD acquired then developed an in-house AI division.

Always eager to boost colleague-led innovation, the bank has also launched an initiative called TD Invent to capitalize on the collective creative power of TD staff. There’s the iD8 program, for example, that encourages staff to submit ideas and has led to more than 18,000 internally crowdsourced concepts (the accessibility app was an internal development with lots of employee input).

“Our colleagues are the backbone of our culture of innovation, ensuring we’re not just keeping up, but setting the pace and maintaining a forward focus in an ever-changing landscape,” said Rizwan Khalfan, Chief Digital and Payments Officer, TD Bank Group. “Behind every patent, every idea and every innovation at TD, stands a team of inventors who are building new and increasingly personalized ways to help serve our customers.”

TD is the sixth largest bank in North America by assets; it cites more than 27.5 million customers and more than 17 million active online and mobile customers.

-30-