The old saying goes that there are only two sure things in life — death and taxes. The April 30 tax deadline looms and it’s expected that more than 75% of Canadians will file their 2013 return electronically this year. If you count yourself among them, you have options to do it with a little less fuss, and some thought into getting organized for upcoming years.

The old saying goes that there are only two sure things in life — death and taxes. The April 30 tax deadline looms and it’s expected that more than 75% of Canadians will file their 2013 return electronically this year. If you count yourself among them, you have options to do it with a little less fuss, and some thought into getting organized for upcoming years.

The two most popular tax software programs are Intuit’s TurboTax and Dr. Tax’s UFile, both of which have evolved and become adept at handling more than just your standard return. Businesses, both incorporated and unincorporated, rental income, investments, RRSPs, TFSAs, medical expenses, deductions, rebates — all are covered.

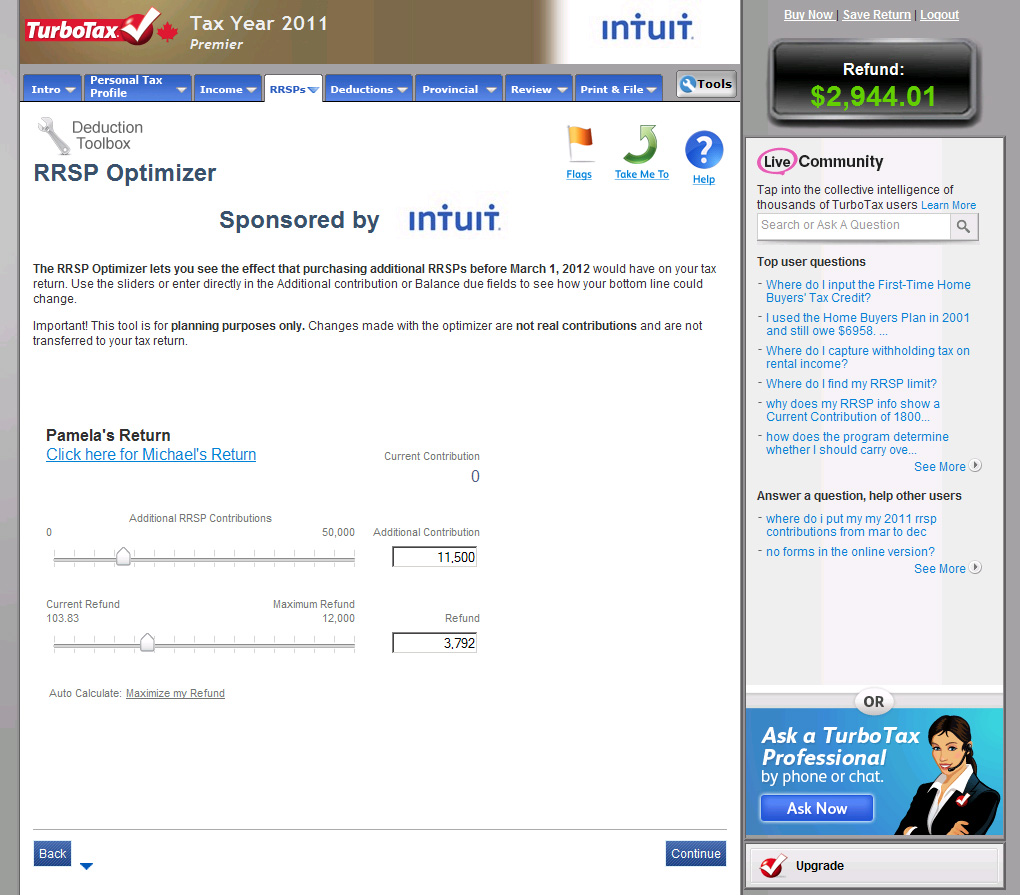

UFile has increased the scope in which Canadians qualify for a free return, ranging from immigrants, pensioners, students and family income under $20,000. TurboTax has aimed to do the same, albeit with a shorter list. Standard returns that only include employment income are free without any income restrictions. Once you get to more intricate financial situations, the company offers a few more options. Standard is ideal if you’re an individual, couple or family and you own a home with limited investments and deductions. Premier is better for those with rental properties, stock portfolios and other investments. Home & Business is for contractors and consultants who work for themselves, regardless of whether they are incorporated or not. It does also cover the investment side of things, so if you’re a business owner that also dabbles in the market or has other investments set aside for retirement, this one will suit you just fine. WhatsYourTech.ca and TurboTax are giving away 5 prizes of TurboTax Standard Tax Year 2013. Enter for your chance to win one!

The benefit of tax software has always been the step-by-step interface that simplifies what is otherwise a difficult process. By holding your hand the whole way through and telling you where to input information, it makes it easier to understand what you’re actually doing. That’s not to say that it’s fun because it really isn’t, but it does help get you through something tedious with just a smidgen of flair and visualization to get it done.

In that, the top two haven’t changed much. The basics remain the same, and no major new features have been added, except for a couple of improvements. The Canada Revenue Agency (CRA) uses NetFile to accept electronic tax returns, which required a four-digit code in the past, but can now be done with one click. TurboTax now offers something called ProReview, where an analyst from Intuit examines your return line by line before filing to make recommendations on improving your bottom line. Naturally, you might not want to wait last minute to take advantage of that service, which costs $35 extra.

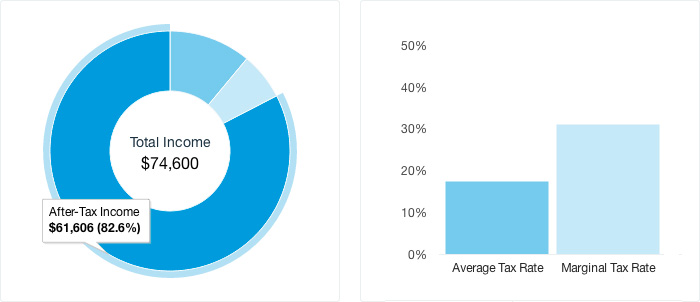

UFile has put together a nice chart showing what the new tax brackets and thresholds are for various tax credits. Otherwise, the software itself hasn’t been touched a great deal from previous years, so if you like what you’ve seen before, you won’t have any issues here.

Then there’s SimpleTax, the newest kid on the block. The free software doesn’t cost anything to use, regardless of income, and the developers only ask for a donation. Its namesake decries what is actually pretty nifty software in what is an unsurprisingly simple layout. It also doesn’t require anything to download because you can use it directly in a Web browser on a PC, Mac, Linux or even an iPad. In case anything goes wrong with your connection, your data and progress are saved, which is a big plus, and something the other vendors offer, too.

Another free software that has been around for a while is StudioTax, which also asks for donations. On top of that, you have Tax Chopper and MyTaxExpress as lower-key, yet capable software applications that can do the job. For those a little more old-fashioned, Taxman and Each Tax both require that you use the CRA’s actual T1 forms to finish the job. At first glance, these all may seem pedestrian, but don’t be fooled. There’s more than meets the eye to them, though if you need the extra care provided by the bigger guys, these options may not be for you.

Also going the free route this year is H&R Block, which allows the first return to be completely free no matter how complex the tax situation might be. Each additional return afterward is $10 each. This is a total departure from how the company first broke into the consumer tax software market, competing with the others on price and selling its boxed product in retail. Now, you can download the software or go through the process using its browser-based program. And if you have a question that can’t be answered on the site, talking to an agent at one of the company’s locations is always an option.

Also going the free route this year is H&R Block, which allows the first return to be completely free no matter how complex the tax situation might be. Each additional return afterward is $10 each. This is a total departure from how the company first broke into the consumer tax software market, competing with the others on price and selling its boxed product in retail. Now, you can download the software or go through the process using its browser-based program. And if you have a question that can’t be answered on the site, talking to an agent at one of the company’s locations is always an option.

Note, however, that TurboTax and UFile also have support personnel that you can call in case you run into a snag.

As much as it is great to do your taxes painlessly, those of you who have to write off expenses and manage deductions will need to drudge up that folder or shoebox of paper and bring out the calculator. Of course, if you’ve kept detailed records or used a program like Quicken or QuickBooks to stay on top of your business affairs, you may already be one step ahead.

Still, it might not hurt to have a good tool for the sake of efficiency, expediency and insurance. Using a scanner specifically designed for dealing with receipts, business cards and documents with software that can collect those files in an orderly fashion can be a real boon to doing things right. Two that come to mind are the Fujitsu ScanSnap iX500 and Neat’s NeatConnect cloud scanner.

These two can scan just about anything you throw at them, and their respective software can work with mobile devices and cloud services. Each scan is turned into a PDF, and in the case of NeatConnect’s software, receipts, cards and documents are recognized as such — reading their information and letting you organize them the way you need to. For example, if you wanted to keep all your automotive-related receipts together, you could scan them in succession for placement in the same folder. The software is smart enough to recognize taxes and where the product or service was purchased from (so long as its written on the receipt).

Fujitsu ScanSnap

The ScanSnap doesn’t have the dedicated slots the NeatConnect does, but it does have adjustable paper guides that help you manage whatever size paper you’re putting in there. Paper jams also seldom happen, so your workflow should go uninterrupted. The software can place all the scanned PDFs as you see fit, so it helps to be organized and create the proper folders to know where everything is. Like the NeatConnect software, Fujitsu’s ScanSnap also reads online bills and PDFs downloaded from e-billing sites.

We could go on and on with what these two are capable of, but the gist is that they can process and aggregate a significant amount of paperwork in a very short time. What might have taken a few days could easily be done in a few hours. And moving forward, scanning receipts and documents as the year goes on means you will already be ready when next year’s tax season comes.

The added bonus is that if you would like to go as paperless as you can in your home office, this is a surefire way to make that happen. Of course, you should keep the hard copies of all tax-related items somewhere safe, just in case, and keep backups of the digital files on at least two external hard drives or USB sticks.

And that about covers it. Doing your taxes is never fun, no matter which side of the ledger you end up on, but at least the tools to make it easier get a little bit better every time a new year hits and April 30 rolls around.

Win a TurboTax Standard Tax Year 2013