April may be the month that rings in the spring, but it’s also tax season, that time of year where one looks forward to a healthy return or dreads having to pay even more. Much of this process has now become digitized, with a host of software programs and apps.

Right off the bat, none of these are likely to be as good as a seasoned accountant for tax filers with more complicated income. Self-employed, investors, landlords, foreign property, even foreign sources of income — programs and apps may not be quite good enough yet to maximize savings or generate fatter returns for those cases.

But for everyone else? There should be more than enough there to get it done, and quickly.

Indeed, the simpler the tax return, the more reason to use one of these apps to get it done and get your return back in as little as eight days. Even if you have some investments, like an RRSP, TFSA or securities, it probably won’t take you very long to go through the process.

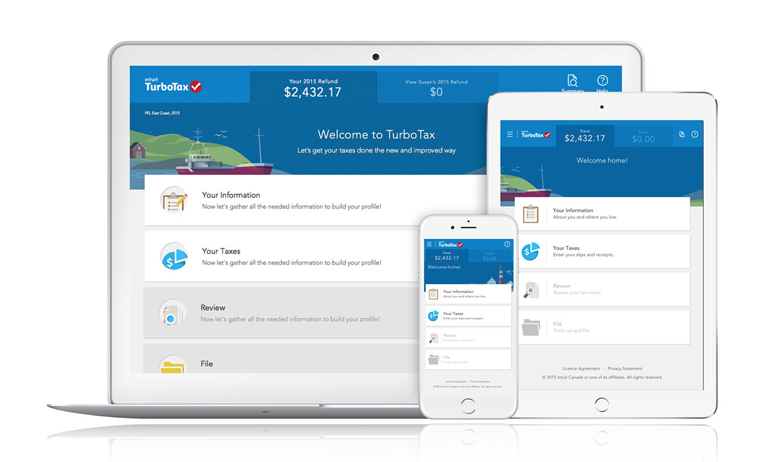

Intuit’s TurboTax is one of the premier services available, having been an excellent resource for years. The web-based filing app is still great, though you can also now make use of the free TurboTax app for iOS and Android. Because you would register or log in to your account, the two are interoperable, meaning you can start your return on one and continue with the other.

It also integrates with the Canada Revenue Agency’s CRA My Account service, which can import tax information and auto-fill the My Return section. One of TurboTax’s standout features has always been the real-time number provided for a return or payment as you go through the process. The number changes as you input your financial info, giving you an idea of where you stand as you go along.

Beyond that, TurboTax does offer other online products ranging from $20-$50 per return, depending on your needs. Business tax products range from $110-$230.

UFile is equally versatile, though it doesn’t segment its various options the same way. UFile Online is a cross-platform product that works on Windows PCs, Macs, smartphones and tablets. It, too, is interoperable, so you can start or continue between one or the other because your return is tied to a UFile account.

Prices start at $18, but you can start your return for free and then pay at the end when you’re ready to file through Netfile, the electronic method that goes straight to the CRA. The difference, however, is that you don’t know what you are receiving or owing until you get to the finish line. It’s up to you on whether you want to proceed, but since it’s aimed at simpler, uncomplicated returns, you may not be inclined to turn back.

Like TurboTax, yearly income under $20,000 is free to file with UFile.

H&R Block has its own tax software, and the incentives are fairly high, with a chart comparing it to TurboTax and UFile. Prior returns completed with either of those two can also be uploaded to H&R Block’s software to get a head start.

To add even more simplicity, it offers a one-size-fits-all product rather than separating programs for particular tax cases. That’s great for clarifying choice, but may not be ideal taxpayers in need of something tailored to their own respective situations. Still, it’s worth a look since there’s no financial commitment up front.

Arguably less known, yet still competitive, are the likes of SimpleTax, StudioTax, GenuTax, TaxTron, TaxFreeway, Cantax, Tax Chopper and others. They vary in what they offer, but are not necessarily any less sophisticated, especially for taxpayers with very straightforward returns.

On the app front, there is File Canada Tax and Snapfile for iOS and Android. And those are on top of the countless tax calculator apps that pop up from a simple search in the App Store and Google Play.

The number of options has grown considerably over the years, and with this level of choice, it may be hard to settle on one. These are great for straightforward returns, and even some that might include investments that don’t have complicated numbers. Really intricate taxes, like those noted earlier, might get more favourable results with a good accountant.

Don’t forget, the filing deadline is May 2. All of the programs and apps support Efile with the CRA for quick returns and negate the need to print or mail any forms.

I used ufile for many years, but last year(for 2015 tax year) I tried to purchase it online and the only thing it did was take my money. After giving my credit card information, the download site or link was never presented. I had to purchase it again and buy a copy from a local store to get my taxes done. A search of the online comments on ufile’s community site, showed that others had the same problem. All email requests about my issue were ignored, even though the autoresponses did respond to my email address, so it was not an issue with my email.

HI Ted,

I always like to remind post-secondary students that UFile ONLINE is Free for them, regardless of their income.See more at http://www.ufile.ca/tips-and-tools/file-for-free

To be clear, all versions of UFile (Online and desktop) can prepare any kind of tax return and there is no extra charge for more complex returns, unlike TT.

Like TT, it offers AutoFill My Return and UFile can also import carryforwards from TT and HRB.

Thanks for the mention.

Joanne

Sr. Director Marketing at UFile

(Thomson Reuters)