March is Fraud Prevention Month, which means it’s prime time to bring attention to the various types of fraud and scams that nefarious individuals use to turn average Joes into victims.

Scammers capitalize on our daily use of various technology to attack people in a number of ways, like by phone, e-mails, and even text messages.

Fraud by Phone

One of the latest tactics by fraudsters is to call a number, then play back an automated message saying that the police are looking for you, and if you don’t pay attention to this “matter” immediately, you will be arrested.

How to combat it: Don’t fall for the scam, even if it looks like the call is coming from your local police station. Scammers know how to “spoof” a number so it appears like a call is coming from a number that it isn’t. Hang up, and call your local police station after looking up the number to confirm you have the right one. It’s likely not true. Why would police call you, after all, if you are to be arrested? They’d probably just come and arrest you!

Nowadays, right in the throes of tax season, calls are coming in fast and furious from individuals purporting to be from Canada Revenue Agency (CRA) and advising that you have unpaid taxes that must be paid immediately. According to the RCMP, this scam alone has victimized more than 4,000 people, and resulted in the loss of $15 million. And it’s no surprise, seeing as scammers use urgency and even outright threats to scare unknowing victims – often the elderly or newcomers to the country – who might wrongfully believe that it’s legitimate.

How to combat it: While the CRA might call you for legitimate reasons, they will never use aggressive language or threats. If the caller is asking for personal information, don’t give it. Simply say you’ll ring back to verify the authenticity of the call. Look up the number of your local police department, or the CRA, call back, and explain the call. Chances are that it was a scam. If it wasn’t, they’ll let you know.

Fraud by E-mail

Some of the most common e-mail scams today involve persons suggesting that the scammer has gained access to your computer, and will release those “compromising photos,” documents, videos, or whatever they might suggest, if you don’t send money immediately to a specific account. Sometimes, the e-mail might even appear to be coming from your own account as “proof” that they have indeed gotten into your computer.

Some of the most common e-mail scams today involve persons suggesting that the scammer has gained access to your computer, and will release those “compromising photos,” documents, videos, or whatever they might suggest, if you don’t send money immediately to a specific account. Sometimes, the e-mail might even appear to be coming from your own account as “proof” that they have indeed gotten into your computer.

How to combat it: Delete, delete, delete. Just ignore it. The message is completely bogus, and the e-mail address often “spoofed,” just like scammers can spoof phone numbers, to appear as though it is you. Of course there are cases where a hacker could indeed get a hold of your computer. But chances are they’ll gain access to steal your personal files, credit card numbers, and other identity details to sell on the black market before they try and shake you down for $1,000.

E-mail phishing scams of all kinds exist, though, typically urging you to visit a fraudulent website (that often looks legitimate but is really a fake replica), like that of a bank, the CRA, or other business. Usually, the e-mail will ask you to click into the link and enter personal information to confirm something (e.g. your account information) or complete a process of some sort (e.g. a service renewal). But really, it’s a scammer looking to steal your personal information, like passwords, credit card numbers, and more.

How to combat it: Once again, delete, delete, delete. A good idea is to hover your cursor over the hyperlink. You’ll likely see that the actual address that shows up does not match what it claims to be. Do not click on it. If you’ve accidentally done so and feel like you might have been a victim, contact your bank, credit card company, and credit bureau immediately to alert them, and update the security software on your computer. It’s also a good idea to report it to the Canadian Anti-Fraud Centre, and even the local police (call the station, however – don’t dial 9-1-1!) Your bank or financial institution might have their own office for reporting fraudulent calls, e-mails, and text messages. Look it up or contact them to find out where you can send a copy of an e-mail purporting to be from them for review and investigation. CIBC, for example, has a special e-mail address set up where customers can forward copies of suspected fraudulent e-mails that appear to be coming from them.

Fraud by Text Message

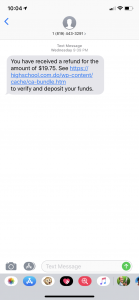

The Canadian Anti-Fraud Centre is warning the public about an increasing number of text messaging scams that, once again, attempt to get mobile phone users to release personal information. These can impersonate everyone from a financial institution to the government, a collections agency, or even offer seemingly innocent opportunities for making money by working from home. I received one recently, for example, noting that I received a refund of $19.75, and to click a link to deposit the funds. Another indicated that I received a payment. It included a lengthy reference number (to appear legitimate) and a link to click to get more details.

How to combat it: Ignore and delete the message. Most organizations will not reach out by text message. If you think it might be legitimate, contact the company or organization directly to confirm authenticity. Or follow one simple rule: if it seems too good to be true (e.g. someone sending you money for no good reason) it probably is.

General Tips to Prevent Becoming a Victim of Fraud

The RCMP provides some general tips on how to prevent being a victim of fraud. First, be suspicious of e-mails or text messages that seem to request urgent replies that require personal or financial information. Always contact the organization yourself using a legitimate phone number to confirm. Never send your personal or financial information by e-mail; and never clicks on links in e-mails unless you can verify that it’s authentic. And finally, install anti-virus software that can provide a layer of defense against fraud, and unauthorized access of your computer and personal files and information.

Related:

Privacy