The fallout continues after the July 8 outage at Rogers that knocked out mobile, landline and Internet service to millions of its customers across Canada. The company appointed a new chief technology and information officer following the 19-hour service outage, but calls for a robust back-up plan to avoid future fails will not ebb.

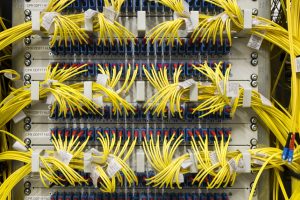

An Internet interconnection patch panel inside an Internet exchange facility. Even other networks reportedly could not handle the flood of extra customers following the Rogers outage. Image DE-CIX.

Government investigations and hearings into the country-wide Internet, telecom and cell phone outage were quickly launched, and Minister of Innovation, Science and Industry François-Philippe Champagne directed Canada’s major telecom companies to find a way to work together and assist each other during outages. He told a House of Commons standing committee that he demanded the companies ink a binding agreement to improve network resiliency and reliability.

Rogers, Bell and Telus (together, they are said to control more than 90 per cent of the country’s telecom business) are apparently reviewing preventative steps and possible remedies for potential future outages; they are expected to report back to Ottawa in the fall.

But Rogers said in a document responding to the current investigation that it was unable to switch customers to competing carriers despite offers of assistance from Bell and Telus. The parts of its system it would need to make the switch were down during the outage.

Even had Rogers been able to switch over in an attempt to obtain back-up protection, it said the competing networks could not handle the flood of extra customers, more than 10 million.

Many of the technical and operational specifics were redacted from the publicly released version of the document that Rogers submitted to the CRTC, apparently for “security and competitive purposes.”

The related data traffic surge could also have impeded operations on the other carriers’ networks, it said. However, many of the technical and operational specifics were redacted from the publicly released version of the document submitted to the CRTC, for “security and competitive purposes.”

Rogers Chief Executive Officer Tony Staffieri did specify that the company would spend at least $250 million to boost its network strength and resiliency by separating its wired and wireless networks, providing some back up for itself.

One might suppose where that money is coming from, but only speculate where the money might be to back up the whole country’s Internet. We’ve learned in a dress rehearsal kind of way that, yes, individual consumers, small businesses and large institutions all depend on the Internet. In an existential kind of way.

And there are entire industries dependent on the Internet being up and running, and not just the telecom industry.

In 2021, Internet advertising revenue in Canada surpassed $12 billion Canadian, the most here ever. IAB Canada forecasts Internet ad revenue growth of 23 per cent this year, followed by another 29.5 per cent in 2023. Of that $12 billion Internet revenue generated in 2021, only about $1 billion is attributed to domestic companies.

Google and Facebook dominate Internet advertising market in Canada, of course. In 2019, their combined share of the online advertising market climbed to 80 per cent; in the first half of 2020, Facebook reported revenues of more than $1 billion in Canada alone.

According to the latest financial report released by parent company Meta, Facebook’s overall ad revenues in 2021 hit $115 billion (USD now), an annual increase of 36.6 per cent.

Canada does levy federal Goods and Services Tax on e-commerce transactions conducted over computer networks and it is considering a kind of DST, or Digital Services Tax, to be levied on the sales of digital services or goods. However, non-resident providers are only liable if they have a permanent establishment in Canada.

Perhaps social media companies that profit so well off a robust and resilient Internet in Canada could be a source of resiliency funding for the country’s online infrastructure.

Then, there’s online gambling, another of Canada’s more profitable online businesses, said to generate more than $15 billion every year. It’s one of the fastest-growing industries in Canada: with more than 19 million active online gamblers, Canada is in the Top Ten among countries that spend the most money gambling online.

Many provinces are already taking advantage of the lucrative industry, with new tax legislation and definitions in Ontario, Alberta, British Columbia, Nova Scotia and Saskatchewan.

But Canadians spend more than $4 billion on offshore online gambling sites every year and, based on the Canadian Gaming Industry Report, some $16 billion in local casinos. In provincial jurisdictions like Ontario, the tax rate on online gambling sites is still much lower than on casinos.

So perhaps the virtual gambling table is where we may find a funding windfall to deal with the outage fallout.

Or perhaps the one word we want to say is plastics. As in plastic credit cards and the issuing companies that depend so much on telecom connectivity. Having recently raised the swipe fees they charge each and every time we use a credit card by 25 per cent, they generated a record $137.8 billion for credit and debit cards combined.

Just as gas taxes help keep our roads resilient and ready for travel, digital services taxes on some emerging or untapped sources might help keep our Internet up and running.

-30-