At its Worldwide Developers Conference earlier this summer, Apple announced the forthcoming rollout of its digital legacy management program called Legacy Contact. With so much of our lives being digital, it is not surprising that Apple is (finally) addressing ways for customers to manage the legacy of their digital assets.

I asked Daniel Goldgut, lawyer and co-founder/CEO of Epilogue, Sharon Hartung, author of Your Digital Undertaker, and Jessie Vaid, co-founder and CEO, ReadyWhen to comment on the necessity of managing one’s digital legacy and how our digital lives and the pandemic have disrupted estate planning.

I asked Daniel Goldgut, lawyer and co-founder/CEO of Epilogue, Sharon Hartung, author of Your Digital Undertaker, and Jessie Vaid, co-founder and CEO, ReadyWhen to comment on the necessity of managing one’s digital legacy and how our digital lives and the pandemic have disrupted estate planning.

Q: What are digital legacies, and why are they important?

Goldgut: “A digital legacy is the online presence someone leaves behind after they pass away. It’s a collection of profiles and accounts that can live on long after we’re gone. Digital legacies are a unique subset of digital assets, which broadly include things like social media accounts, cloud accounts, email accounts, blog or web domains, etc.”

Hartung: “Digital assets may simply be electronic records, but they are the digital gateway to clients’ lives and estates.”

gateway to clients’ lives and estates.”

“The pandemic has further accelerated our digital use to the extent that everything we own, whether that is our bank accounts, investment portfolio or personal property, has a digital trail, and that alone has quietly transformed estate planning and the role of the executor in estate administration”.

Goldgut: “So much of what we do is now digital. So, in a way, technology underpins everything we do. It’s how we communicate, document, store information, and pay for things. Whether you realize it or not, everyone has a significant digital footprint they are going to leave behind—whether that’s email, loyalty rewards points, cryptocurrencies, NFT’s, digital accounts associated with home management like Google’s Nest, or even dating apps.”

2. What digital assets and estate planning tools can advisers use to understand and better manage their client’s estate?

Hartung: “The digitization of the estate industry is still in its infancy with tech entrepreneurs having emerged in the estate space only a few years ago. The entire business process lifecycle from client engagement to the back-end probate processes is being transformed and will continue to expand as electronic wills become legislated jurisdictionally.”

“We are also on the doorstep of electronic wills, which are digital assets unto themselves, representing the tip of the industry’s transformation that will quietly drive a wave of digitization throughout the entire estate industry. Watch as the entire end-to-end processes of estate planning and administration and the associated businesses connect and electrify as a result.”

Hartung added, “To provide some examples, consider Will drafting has moved on-line for both the DIY wills, like EpilogueWills and will drafting solutions, like eStatePlanner, for legal firms.

“Digital assets digital vaults, like Directive Communication Systems and Legacy Concierge, [also allow us] to manage our growing online accounts. On-line Estate binders with secure platform and workflow from the testator (will-maker) to the fiduciary/executor such as ReadyWhen and estate administration and settlement solutions like Estateably are also on offer.”

“The pandemic increased our reliance on technology and the internet to navigate our worlds where now the idea of remote will-signing or electronic wills is part of mainstream conversation.”

Goldgut: “The prudent way to document your wishes for your digital assets is in a legal Will. It will become your executor’s responsibility to manage your estate, which includes your digital assets. Today’s executor often has the extra burden of being responsible for finding, managing and dealing with your digital assets and digital legacy.”

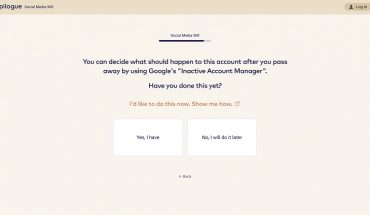

“There are some tools that can help people when it comes to managing digital assets and digital legacies. Epilogue’s Social Media Will helps people document their wishes for their social media accounts for when they’re no longer here.”

Q: Which social media platforms offer digital legacy features?

Goldgut: “When it comes to legacy pre-planning on social media platforms, they are not all created equal. The platforms that are really doing it right are also not only addressing what happens to someone’s account in the event of death, but also cover incapacity.”

“At Epilogue, we did a deep dive into the Legacy Planning options of Facebook, Twitter, Instagram, LinkedIn, Google, and Apple in collaboration with Sharon Hartung, author of Your Digital Undertaker,” shared Goldgut. “We even developed a Social Legacy Score Card that shows how each platform stacks up against the other.”

“The top-performing platform when it comes to pre-planning is Facebook, which has engaged experts like Dr. Jed Brubaker of the University of Colorado Boulder, to help develop their Legacy Contact feature. They offer pre-planning features like the ability to assign a Legacy Contact who can access your account after you pass away, and the ability to pre-select whether you want your account memorialized or shut down.”

“The top-performing platform when it comes to pre-planning is Facebook, which has engaged experts like Dr. Jed Brubaker of the University of Colorado Boulder, to help develop their Legacy Contact feature. They offer pre-planning features like the ability to assign a Legacy Contact who can access your account after you pass away, and the ability to pre-select whether you want your account memorialized or shut down.”

“At the lower end is Twitter. They don’t have any pre-planning options to address death or incapacity.”

“It’s clear there’s still lots of work to be done when it comes to pre-planning options on social media platforms. The announcement of Apple’s new Legacy Contact feature is important as Apple often sets the standards in the tech ecosystem, so hopefully the service providers that are currently lagging will now feel the pressure to catch up.”

Hartung: “If available, pre-planning options are typically found in account settings and searchable in help. While it is relatively easy for an executor to shut down any account, things become more challenging to access or transfer data and information if these pre-planning options are not selected.”

Q: Have you seen an uptick in digital will creation? In Canada, are there any roadblocks to having digital legacies upheld?

Jessie Vaid, co-founder & CEO ReadyWhen,

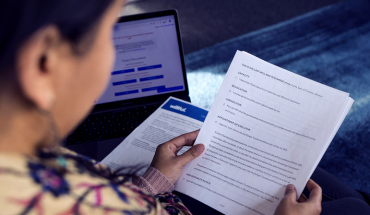

I asked Jessie Vaid, co-founder of ReadyWhen, a fully digital platform that allows Canadians to proactively build and store a complete estate plan from their laptop or mobile device, for comment on this.

Vaid: “COVID changed many industries, expediting the need for a sophisticated digital strategy from “in 5 years” to immediately to ensure they could evolve with the sudden change in regulations and behaviour. The legal and estate planning industries have not been exempted from this digitization trend.”

“In 2020, year over year estate planning searches increased by 72% in Canada and 31% in the United States.”

“Across Canada, we are also seeing that 16% of 18 – 34-year-olds are more likely to have a will than those in the 35 – 54 age group. The younger generation is also the most likely to cite COVID-19 as the reason they started taking estate planning seriously.”

“The legal industry and regulators are still slow to meet this demand. For instance, some provinces have allowed the remote signing of estate documents during the pandemic and with emergency orders, but as of right now there isn’t a single province that will accept a digital will. There is legislation sitting to approve it, but it’s still a paper-heavy industry that relies on consumers to use their filing cabinets to safely store important information.”

Clearly, the tech companies and estate advisors are evolving in ways to best manage our digital assets once we are gone. Have you made your estate arrangements?

-30-

Further Reading: Sharon Hartung is the author of two digital asset management and estate planning books. Both books focus on digital assets in estate planning from a technologist’s point of view. Her latest book “Digital Executor®: Unraveling the New Path for Estate Planning (2021), is about digital assets in the context of the digitization of the entire global estate industry,” explained Hartung. “It covers the changing role of the advisor, the increasingly digital expectations of consumers and implications of legislated electronic wills, where I predict the digital ‘race’ has begun to build integrated client estate banking and life planning platforms, to follow clients, their lives, their legacy and their money from #fintech to #estatetech.”

Related:

Frontline Healthcare Workers Receive Help with Wills and End-of-Life Plans

Woman-led Online Company Disrupts Cremation Services Business